All Categories

Featured

Table of Contents

- – The Essentials: What is Level Term Life Insura...

- – Why Decreasing Term Life Insurance Could Be th...

- – Key Features of Decreasing Term Life Insuranc...

- – Is Term Life Insurance With Accidental Death ...

- – What is Term Life Insurance With Level Premi...

- – What is 10-year Level Term Life Insurance? Q...

If George is identified with a terminal ailment throughout the first plan term, he possibly will not be eligible to restore the policy when it expires. Some plans supply ensured re-insurability (without proof of insurability), however such attributes come at a higher price. There are a number of types of term life insurance policy.

Most term life insurance coverage has a level costs, and it's the kind we've been referring to in most of this short article.

Term life insurance coverage is appealing to youngsters with kids. Parents can obtain considerable protection for an inexpensive, and if the insured dies while the plan is in impact, the family members can count on the survivor benefit to replace lost earnings. These plans are also well-suited for people with expanding households.

The Essentials: What is Level Term Life Insurance Meaning?

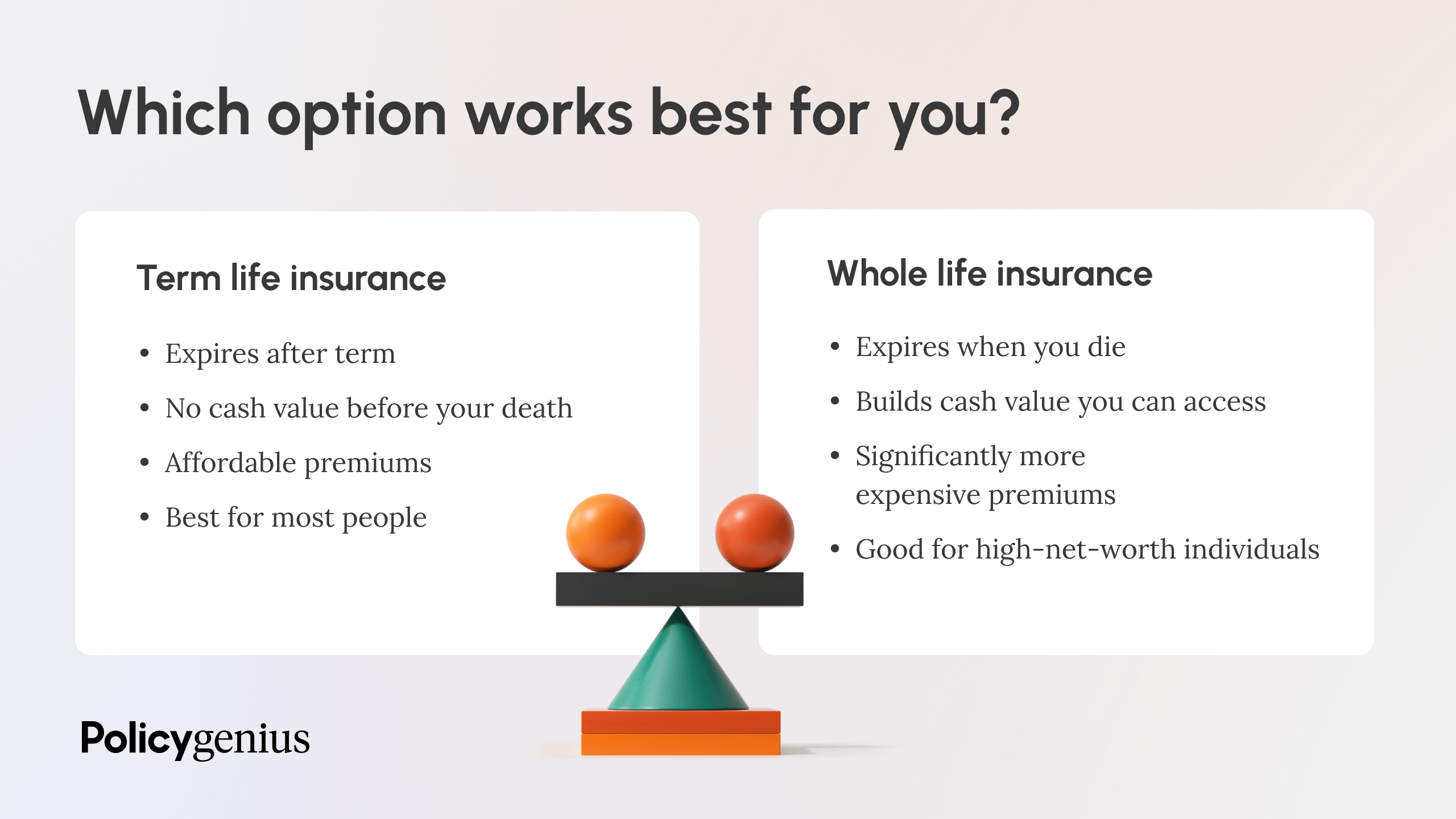

Term life policies are perfect for people who desire significant protection at a reduced cost. People that have entire life insurance pay a lot more in costs for less protection but have the safety of recognizing they are protected for life.

The conversion cyclist should enable you to transform to any type of long-term policy the insurance coverage business offers without restrictions. The primary attributes of the motorcyclist are keeping the original health ranking of the term plan upon conversion (even if you later have health and wellness problems or come to be uninsurable) and making a decision when and just how much of the insurance coverage to convert.

Of training course, total premiums will raise considerably given that whole life insurance is much more pricey than term life insurance policy. The benefit is the assured approval without a clinical examination. Clinical problems that develop during the term life duration can not cause costs to be increased. The company may require limited or full underwriting if you desire to include added motorcyclists to the brand-new policy, such as a lasting care biker.

Why Decreasing Term Life Insurance Could Be the Best Option?

Term life insurance coverage is a fairly cost-effective means to offer a round figure to your dependents if something happens to you. It can be a good alternative if you are young and healthy and support a family. Whole life insurance includes substantially greater regular monthly premiums. It is implied to offer insurance coverage for as long as you live.

It relies on their age. Insurance provider set an optimum age limit for term life insurance coverage plans. This is usually 80 to 90 years of ages however might be greater or reduced depending upon the firm. The costs likewise climbs with age, so an individual aged 60 or 70 will pay considerably greater than somebody decades younger.

Term life is rather similar to automobile insurance coverage. It's statistically unlikely that you'll require it, and the costs are cash away if you do not. But if the worst happens, your family will get the benefits (Joint term life insurance).

Key Features of Decreasing Term Life Insurance Explained

Generally, there are 2 sorts of life insurance plans - either term or irreversible plans or some mix of both. Life insurance firms offer various kinds of term strategies and conventional life policies in addition to "rate of interest sensitive" products which have actually come to be much more widespread considering that the 1980's.

Term insurance provides defense for a specific time period. This duration can be as brief as one year or supply insurance coverage for a specific number of years such as 5, 10, 20 years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance coverage mortality.

Is Term Life Insurance With Accidental Death Benefit the Right Choice for You?

Presently term insurance coverage rates are really competitive and among the least expensive traditionally experienced. It should be noted that it is an extensively held belief that term insurance coverage is the least pricey pure life insurance policy coverage readily available. One needs to assess the plan terms meticulously to determine which term life options appropriate to fulfill your specific conditions.

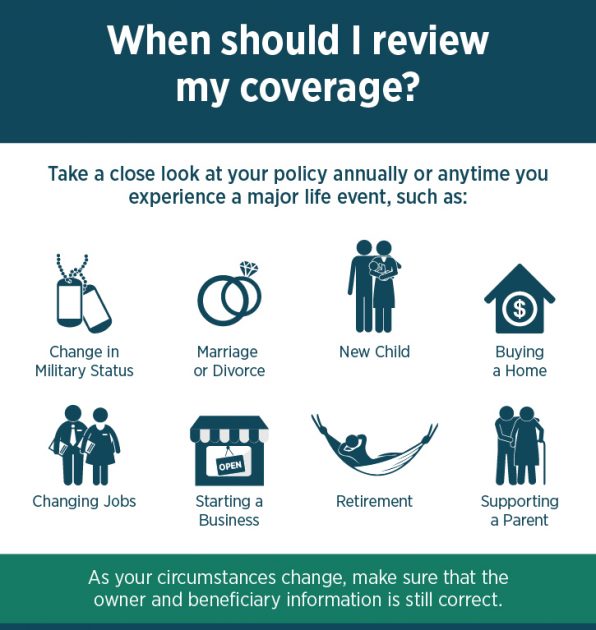

With each new term the premium is raised. The right to restore the plan without proof of insurability is an essential advantage to you. Or else, the risk you take is that your health might degrade and you might be incapable to obtain a plan at the same rates or even in any way, leaving you and your beneficiaries without protection.

The size of the conversion duration will vary depending on the type of term policy acquired. The premium price you pay on conversion is normally based on your "existing attained age", which is your age on the conversion date.

Under a level term plan the face amount of the policy remains the same for the entire duration. Often such policies are offered as mortgage security with the amount of insurance coverage decreasing as the balance of the home loan decreases.

Typically, insurance providers have actually not deserved to change premiums after the plan is sold. Given that such policies might proceed for lots of years, insurance firms have to utilize traditional death, interest and expense price estimates in the costs estimation. Flexible costs insurance policy, nonetheless, allows insurance companies to supply insurance at lower "existing" premiums based upon less conventional assumptions with the right to change these costs in the future.

What is Term Life Insurance With Level Premiums and Why Choose It?

While term insurance is made to supply defense for a specified amount of time, permanent insurance coverage is developed to offer insurance coverage for your whole life time. To keep the premium price level, the costs at the more youthful ages goes beyond the actual price of protection. This additional costs constructs a book (cash worth) which assists spend for the policy in later years as the cost of defense rises above the premium.

The insurance coverage company invests the excess costs dollars This type of plan, which is in some cases called money worth life insurance policy, generates a savings aspect. Cash money values are important to a permanent life insurance plan.

Sometimes, there is no relationship in between the dimension of the cash worth and the premiums paid. It is the cash money worth of the policy that can be accessed while the policyholder lives. The Commissioners 1980 Criterion Ordinary Mortality (CSO) is the existing table used in computing minimal nonforfeiture values and plan gets for ordinary life insurance policy plans.

What is 10-year Level Term Life Insurance? Quick Overview

Numerous long-term plans will certainly contain provisions, which specify these tax obligation requirements. Standard whole life plans are based upon long-lasting quotes of expense, rate of interest and mortality.

Table of Contents

- – The Essentials: What is Level Term Life Insura...

- – Why Decreasing Term Life Insurance Could Be th...

- – Key Features of Decreasing Term Life Insuranc...

- – Is Term Life Insurance With Accidental Death ...

- – What is Term Life Insurance With Level Premi...

- – What is 10-year Level Term Life Insurance? Q...

Latest Posts

Insurance To Pay For Funeral

Last Expense Life Insurance

What Is The Best Burial Insurance For Seniors

More

Latest Posts

Insurance To Pay For Funeral

Last Expense Life Insurance

What Is The Best Burial Insurance For Seniors