All Categories

Featured

Table of Contents

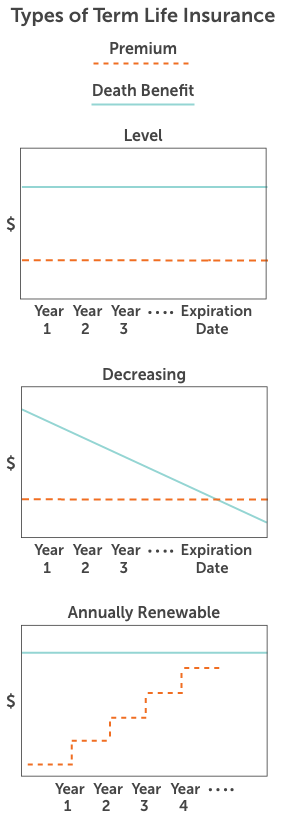

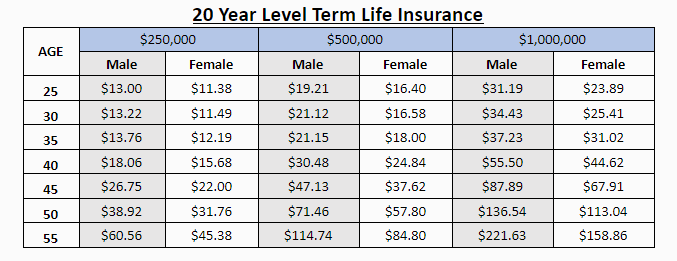

A level term life insurance coverage policy can offer you tranquility of mind that individuals who depend upon you will certainly have a death advantage during the years that you are intending to sustain them. It's a means to aid deal with them in the future, today. A degree term life insurance policy (occasionally called level costs term life insurance policy) plan offers protection for a set number of years (e.g., 10 or twenty years) while maintaining the premium settlements the very same throughout of the plan.

With level term insurance coverage, the price of the insurance will remain the very same (or potentially reduce if dividends are paid) over the regard to your policy, usually 10 or 20 years. Unlike long-term life insurance policy, which never ever expires as long as you pay premiums, a degree term life insurance policy plan will end at some factor in the future, generally at the end of the duration of your degree term.

How Does Decreasing Term Life Insurance Benefit Families?

Because of this, many individuals use irreversible insurance policy as a secure economic planning tool that can offer numerous requirements. You might have the ability to transform some, or all, of your term insurance policy during a set duration, commonly the initial one decade of your policy, without requiring to re-qualify for protection also if your health and wellness has actually changed.

As it does, you might want to add to your insurance policy protection in the future. When you initially get insurance coverage, you may have little financial savings and a big home loan. Ultimately, your savings will certainly grow and your home loan will diminish. As this happens, you may wish to eventually minimize your survivor benefit or consider converting your term insurance policy to an irreversible policy.

Long as you pay your costs, you can rest very easy recognizing that your loved ones will certainly get a fatality advantage if you die during the term. Many term plans allow you the ability to convert to irreversible insurance policy without having to take one more wellness examination. This can permit you to make the most of the fringe benefits of an irreversible plan.

Level term life insurance is just one of the easiest paths into life insurance, we'll talk about the advantages and disadvantages to make sure that you can choose a strategy to fit your needs. Level term life insurance coverage is the most common and standard type of term life. When you're trying to find short-lived life insurance policy plans, degree term life insurance policy is one course that you can go.

The application process for level term life insurance policy is generally extremely simple. You'll load out an application which contains general personal info such as your name, age, etc as well as a much more detailed questionnaire regarding your medical history. Depending upon the plan you're interested in, you might have to take part in a medical checkup process.

The brief solution is no., for example, let you have the comfort of fatality benefits and can accrue cash worth over time, implying you'll have much more control over your benefits while you're alive.

What is Level Benefit Term Life Insurance? A Beginner's Guide

Motorcyclists are optional provisions contributed to your plan that can offer you extra advantages and defenses. Bikers are a fantastic means to include safeguards to your policy. Anything can occur over the program of your life insurance policy term, and you wish to await anything. By paying just a bit much more a month, riders can supply the support you need in instance of an emergency situation.

This biker provides term life insurance policy on your youngsters with the ages of 18-25. There are circumstances where these benefits are constructed right into your policy, however they can likewise be available as a separate addition that requires added repayment. This biker offers an extra survivor benefit to your beneficiary ought to you die as the outcome of an accident.

Latest Posts

Insurance To Pay For Funeral

Last Expense Life Insurance

What Is The Best Burial Insurance For Seniors